August 2011 Expected Dividend: $279 Annual Income $3,274 End-of-term Asset: $60,187 Dividend Return: 5.44% Dividend Growth: -1.2% Yield on Cost 5.28% Monthly $1,000

August 2011 Expected Dividend: $279 Annual Income $3,274 End-of-term Asset: $60,187 Dividend Return: 5.44% Dividend Growth: -1.2% Yield on Cost 5.28% Monthly $1,000

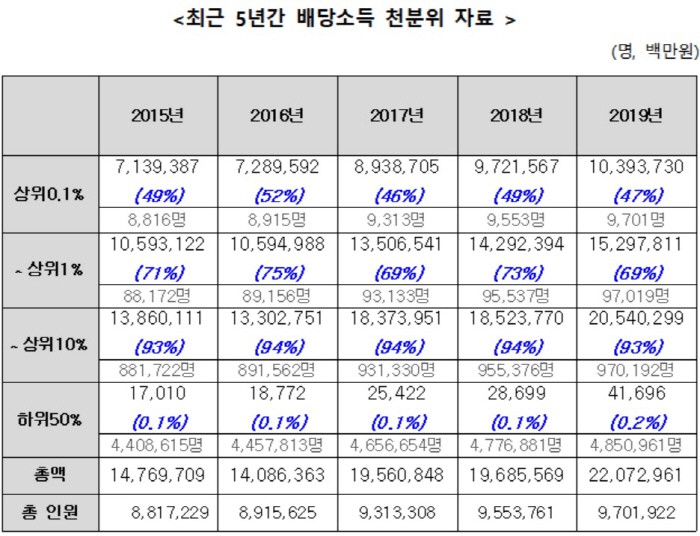

dollar-one five-year chart

If I had invested dollars well… I would have made 30% tax-free plus a return… Why! Back then… Couldn’t they concentrate on investing dollars? ^^;

If I had invested dollars well… I would have made 30% tax-free plus a return… Why! Back then… Couldn’t they concentrate on investing dollars? ^^;

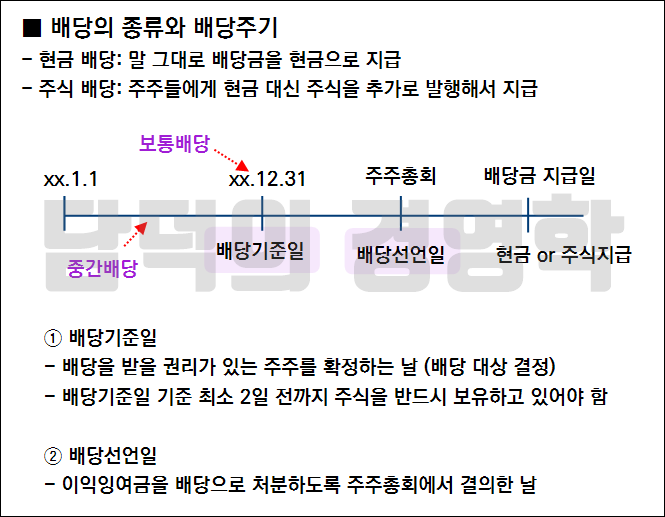

If I had invested dollars well… I would have made 30% tax-free plus a return… Why! Back then… Couldn’t they concentrate on investing dollars? ^^;Anyway, the return on investment in U.S. stocks is +5.28% per month… It’s maintaining the 5% range, but… The current dividend growth rate is -1.2%… Dividend returns to investments are falling. (Crying) In the beginning, we didn’t even calculate the dividend growth rate… It’s a failure to buy only high dividend stocks… ^^; Last year, I was strong… We are collecting mainly dividend growth stocks, but… It feels like it’s been a long time…too bad^^ The challenge for future U.S. stock dividend investment is to continuously switch from high dividend stocks to dividend growth stocks!dividend safetyincrease in dividenddiversificationdiversificationincome calendarincome calendarincome forecastincome forecastincome forecasthttps://www.youtube.com/shorts/kjhwvQpvV_M